Federal Income Tax Rate Florida 2025. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. The federal income tax system is progressive, so the rate of taxation increases as income increases.

The 2025 tax rates and thresholds for both the florida state tax tables and federal tax tables are comprehensively integrated into the florida tax calculator for 2025. Income tax tables and other tax information is sourced from the florida department of revenue.

CARPE DIEM Average Federal Tax Rates By Group Are Highly, Deduct the amount of tax paid from the tax calculation to provide an example. Here are the tax brackets for tax years 2025 and 2025, and how you can figure out which tax bracket you fit into.

How Federal Tax Rates Work Urban Institute, Updated on apr 24 2025. Free tool to calculate your hourly and salary income.

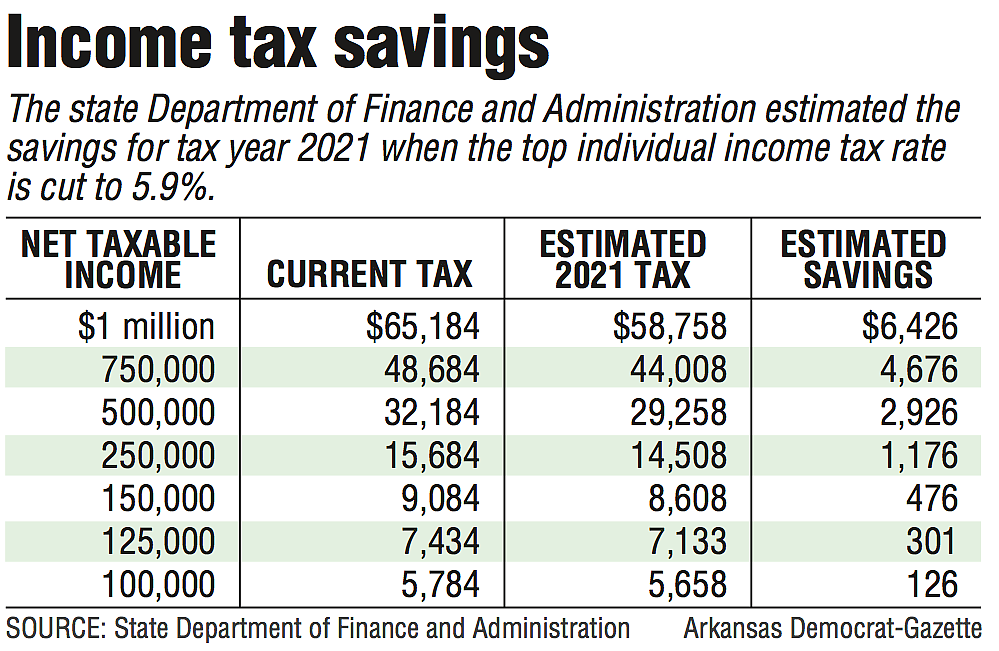

The state’s highest tax charge drops to five.9 immediately, Just enter your salary or hourly income. These figures are for the 2025 tax year.

2025 tax brackets Lashell Ahern, The salary tax calculator for florida income tax calculations. 15, 2025, with an extension.

Arizona State Tax Brackets 2025 Aline Beitris, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. 15, 2025, with an extension.

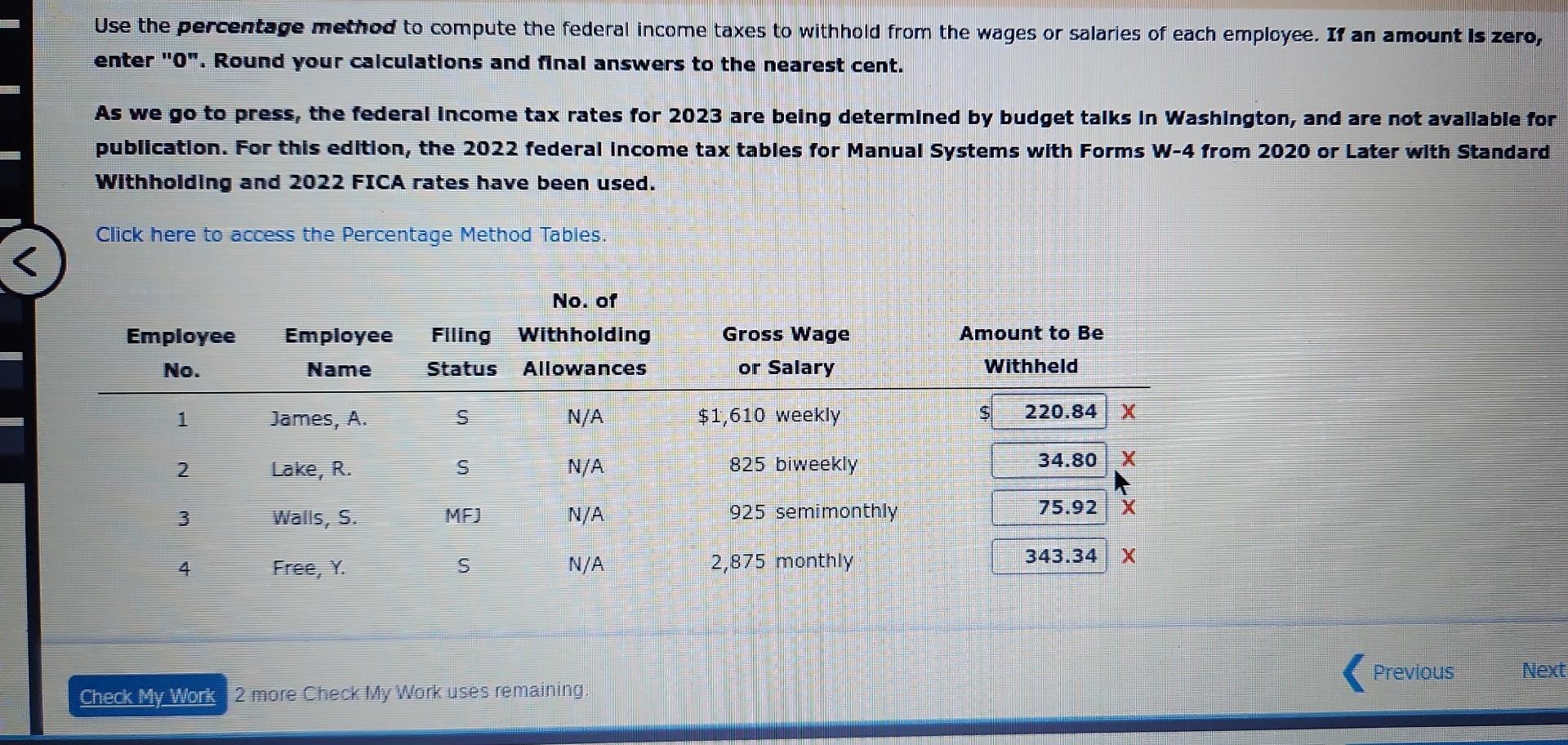

Solved Use the percentage method to compute the federal, Deduct the amount of tax paid from the tax calculation to provide an example. People in the top 1% paid an average income tax rate of 26%, compared to those in the bottom 50%, who paid an average income tax rate of 3.1%, according to the.

Nyc Supplemental Tax Rate 2025 Perry Brigitta, Census bureau) number of cities that have local income taxes: The deadline for filing a 2025 federal tax return was april 15, 2025, or oct.

Tax Rates to Celebrate Gulfshore Business, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. Marginal tax rates range from 10% to 37%.

Irs Tax Brackets 2025 Chart Printable Forms Free Online, Census bureau) number of cities that have local income taxes: There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%.

Guillory, Your location will determine whether you owe local and / or. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

People in the top 1% paid an average income tax rate of 26%, compared to those in the bottom 50%, who paid an average income tax rate of 3.1%, according to the.